Medical claims, often referred to as medical malpractice claims, are legal actions taken by patients who allege that they have suffered harm due to the negligence or substandard care provided by healthcare professionals. These claims can arise from various medical settings, including family medicine departments, emergency departments, and tertiary hospitals, and often involve allegations of diagnostic errors, treatment errors, or failure to provide adequate care. The process typically involves a detailed review of medical records and the circumstances surrounding the alleged incident to determine whether a medical error occurred and if it resulted in patient injury. The outcomes of these claims can vary, with some being settled out of court, others dismissed, and a few proceeding to trial, where the verdicts can significantly impact the involved parties both financially and professionally. The analysis of medical claims helps in identifying common areas of risk and can inform strategies to improve patient safety and reduce the incidence of medical errors.

Types of medical claims

Medical claims are essential for the reimbursement of healthcare services provided to patients. They ensure that healthcare providers and institutions receive payment for their services from insurance companies. The primary types of medical claims include the following:

1. Professional Claims

Professional claims are submitted by physicians or healthcare providers for services rendered to patients. These claims typically cover a wide range of medical services, including consultations, diagnostic tests, treatments, and follow-up care. The method of payment for these services can significantly impact the quality and quantity of healthcare provided. For instance, pay-for-performance (P4P) schemes have been shown to improve certain health outcomes, such as child immunization rates and the prescribing of guideline-recommended medications by primary care physicians. However, the effectiveness of these payment methods can vary, and further research is needed to fully understand their impact on healthcare delivery.

2. Institutional Claims

Institutional claims are made by hospitals or other healthcare institutions for inpatient or outpatient services provided to patients. These claims encompass a variety of services, including surgeries, hospital stays, and specialized treatments. The payment methods for these services can influence hospital operations and patient outcomes. For example, fee-for-service (FFS) models may lead to an increase in the quantity of health services provided, but the quality and cost-effectiveness of these services remain uncertain. Institutional claims are crucial for the financial sustainability of healthcare facilities and play a significant role in the overall healthcare system.

3. Dental Claims

Dental claims are submitted for dental services provided to patients, including routine check-ups, cleanings, fillings, and more complex procedures. Changes in reimbursement policies can significantly affect the utilization of dental services. For instance, the elimination of Medicaid reimbursement for adult dental problems led to a decrease in dental-related claims by physicians, as patients assumed that visits to physicians for dental issues would also not be covered. This highlights the importance of consistent and adequate reimbursement policies to ensure access to necessary dental care for all populations.

Components of a Medical Claim

A medical claim consists of several key components that ensure accurate processing and reimbursement for healthcare services. Each component provides essential information about the patient, provider, procedures, and costs involved. The primary components of a medical claim include the following:

1. Patient Details

Patient details are a crucial component of a medical claim, encompassing information such as the patient’s name and insurance ID. This data is essential for identifying the individual receiving medical services and ensuring that the claim is processed correctly by the insurance provider. Accurate patient details help in tracking healthcare utilization and in the prevention of insurance fraud, which is a significant issue in the healthcare industry. Fraudulent claims can lead to substantial financial losses for insurance providers, as highlighted by the billions of dollars lost annually due to such activities. Therefore, maintaining precise and accurate patient information is vital for both administrative efficiency and fraud prevention.

2. Provider Details

Provider details in a medical claim include the healthcare provider’s name and credentials. This information is necessary for verifying the legitimacy of the services rendered and for ensuring that the provider is qualified to perform the procedures billed. The standardized coding systems, such as the Current Procedural Terminology (CPT) developed by the American Medical Association, rely on accurate provider details to process claims correctly and to gather statistical healthcare information. These details also play a role in tracking healthcare utilization and in conducting research to evaluate healthcare services and outcomes, making them an indispensable part of the medical claim process.

3. Procedure Codes

Procedure codes, such as ICD and CPT codes, are integral to medical claims as they provide a standardized language for describing medical, surgical, diagnostic, and therapeutic services. These codes ensure that healthcare data is captured accurately and consistently, facilitating proper claim processing for various health programs, including Medicare and Medicaid. The use of procedure codes also aids in clinical research and in the evaluation of healthcare utilization and outcomes. However, discrepancies between claims data and clinical data can occur, affecting the validity of research outcomes and the accuracy of healthcare statistics. Therefore, precise coding is essential for both administrative and research purposes.

4. Costs Involved

The costs involved in a medical claim encompass the financial aspects of the healthcare services provided, including charges for procedures, consultations, and any additional treatments. Accurate cost information is crucial for the reimbursement process, ensuring that healthcare providers are compensated fairly and that patients are billed correctly. The financial data in medical claims also plays a role in identifying and preventing insurance fraud, as irregularities in cost patterns can signal fraudulent activities. Additionally, cost data is used in healthcare research to analyze the economic impact of medical treatments and to develop cost-effective healthcare policies and practices.

How Medical Claims Work

Understanding how medical claims work is crucial for both healthcare providers and patients. The process involves several key steps, from the initial submission to the final adjudication by the insurance company. The main stages in the medical claims process include the following:

1. Submission Process

Medical claims are typically submitted electronically to insurance companies after a patient receives treatment. This process involves healthcare providers sending detailed information about the medical services rendered, including diagnosis codes, procedure codes, and patient information, to the insurance company. The use of electronic submission helps streamline the process, reduce errors, and speed up the time it takes for claims to be processed. Advanced technologies such as blockchain and smart contracts are being explored to further enhance the efficiency and security of this process by ensuring data integrity and reducing the risk of fraud.

2. Claim Adjudication Process

Once a medical claim is submitted, the insurance company begins the adjudication process. This involves several steps: verifying the patient’s coverage, checking the accuracy of the claim details, and ensuring that the services provided are covered under the patient’s insurance plan. The insurance company may use machine learning and natural language processing techniques to identify potential errors or fraudulent claims. If any discrepancies are found, the claim may be flagged for further review. The adjudication process aims to determine whether the claim should be approved, denied, or if additional information is needed.

3. Common Outcomes

1. Approved Claim: An approved claim means that the insurance company has agreed to pay all or part of the requested amount for the medical services provided. This decision is made after verifying that the claim meets all the necessary criteria and that the services are covered under the patient’s insurance plan. The payment is then processed and sent to the healthcare provider or directly to the patient, depending on the insurance policy.

2. Denied Claim: A denied claim occurs when the insurance company rejects the claim, often due to errors in the submission, lack of coverage for the services provided, or discrepancies in the information provided. Common reasons for denial include incorrect coding, missing information, or services that are not covered under the patient’s insurance plan. Denied claims can be appealed by providing additional information or correcting the errors identified by the insurance company.

3. Pending Claim: A pending claim is one that requires more information or clarification before a final decision can be made. This may happen if the initial submission lacks necessary details or if there are inconsistencies that need to be resolved. The insurance company may request additional documentation from the healthcare provider or the patient to complete the review process. Pending claims can delay payment but are a crucial step in ensuring that all claims are accurately processed.

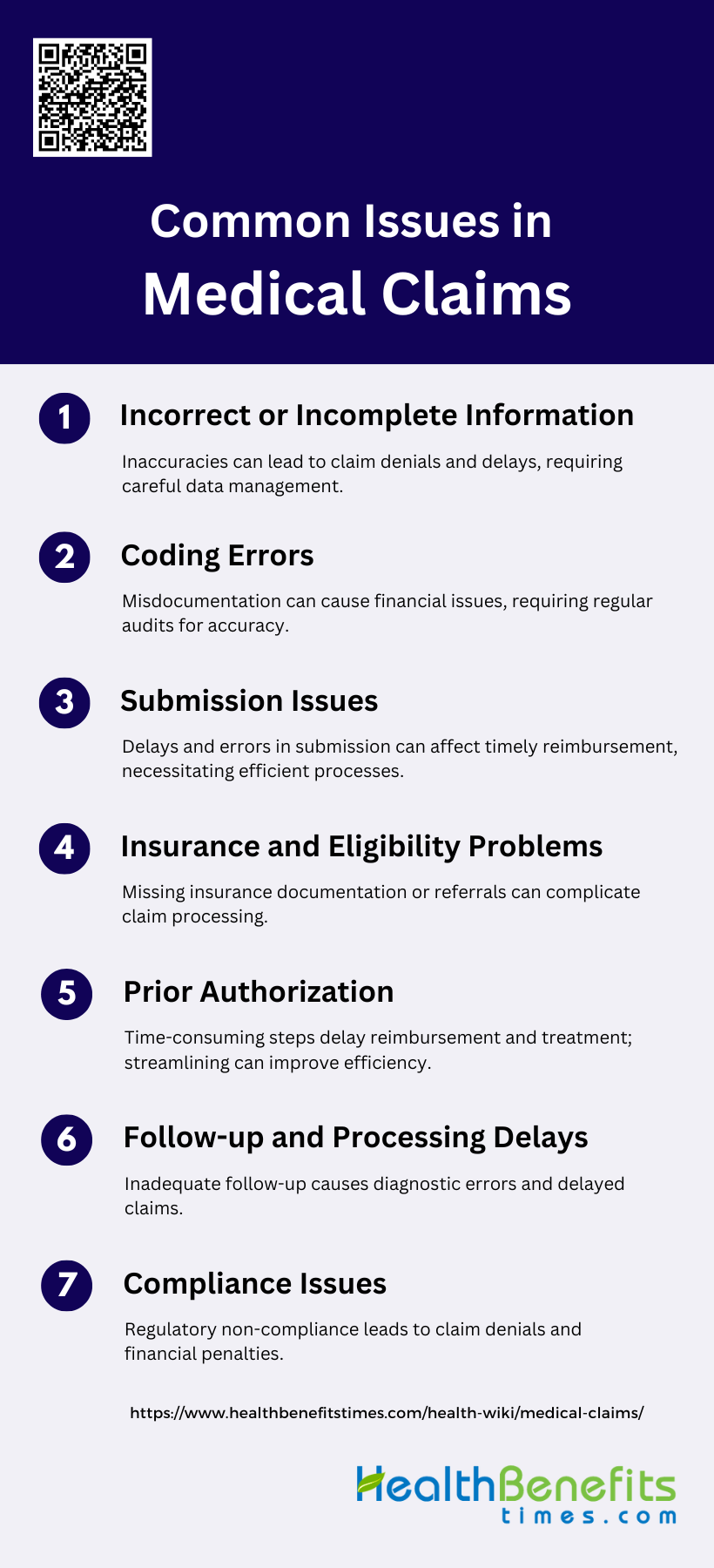

Common Issues in Medical Claims

Medical claims processing can be fraught with various challenges that can delay or deny reimbursement. Understanding these common issues is essential for healthcare providers to ensure smooth and efficient claim handling. The primary issues in medical claims include the following:

1. Incorrect or Incomplete Information

Incorrect or incomplete information is a prevalent issue in medical claims, often leading to claim denials and delays in reimbursement. Incomplete medical records can complicate patient management and administrative operations, resulting in financial losses for healthcare providers. For instance, a study highlighted that incomplete medical records are a significant challenge, with CMS recovery audits showing an increase in hospital denials due to open or incomplete records. Effective measures, such as regular training for healthcare providers on electronic medical records (EMR) and administrative surveillance, are essential to mitigate this issue.

2. Coding Errors

Coding errors are another critical issue that can lead to significant financial and administrative consequences. These errors often arise from inadequate medical documentation and the complex nature of medical coding systems. A study conducted in a Melbourne tertiary hospital found that 16% of audited cases had discrepancies in clinical code assignments, leading to substantial revenue shifts. The most significant factor contributing to these errors was poor quality documentation. Regular audits and improved documentation practices are recommended to enhance coding accuracy and secure proper financial reimbursement.

3. Submission Issues

Submission issues, such as delays and errors in the claim submission process, can hinder timely reimbursement. A study at Soe Public Hospital identified several administrative problems, including incomplete medical records and lack of coordination among staff, which delayed the submission of claims for inpatients. These issues highlight the need for comprehensive and integrated claim submission processes. Regular evaluation of staff responsible for submitting claims and improved coordination among different departments can help address these submission issues.

4. Insurance and Eligibility Problems

Insurance and eligibility problems can also complicate the medical claims process. Patients often face issues such as not having the necessary insurance documentation or referral letters, which can delay or deny their claims. The study at Soe Public Hospital found that many patients did not bring copies of their BPJS Kesehatan cards or referral letters, leading to delays in claim submissions. Ensuring that patients are well-informed about the required documentation and streamlining the eligibility verification process can help mitigate these problems.

5. Prior Authorization

Prior authorization is a common hurdle in the medical claims process, often leading to delays in treatment and reimbursement. The requirement for prior authorization can be a time-consuming process, involving multiple steps and approvals. This can result in delays in patient care and financial strain on healthcare providers. Streamlining the prior authorization process through better communication between healthcare providers and insurers, and utilizing electronic systems for faster approvals, can help reduce these delays and improve the overall efficiency of the claims process.

6. Follow-up and Processing Delays

Follow-up and processing delays are significant issues that can impact the timely reimbursement of medical claims. Delays in reviewing and processing claims can arise from various factors, including inadequate follow-up on test results and diagnostic errors. A study on missed and delayed diagnoses in the ambulatory setting found that failures in ordering appropriate tests and inadequate follow-up were common breakdowns in the diagnostic process. Implementing robust follow-up procedures and ensuring timely review of test results can help reduce these delays and improve patient outcomes.

7. Compliance Issues

Compliance issues, such as failing to adhere to regulatory requirements and guidelines, can lead to claim denials and financial penalties. Healthcare providers must ensure that their coding and billing practices comply with regulatory standards to avoid potential risks, including loss of revenue and fraud investigations. A risk management approach, including regular monitoring and auditing of medical record documentation and coding applications, is essential for achieving compliance and reducing billing errors. This approach can help healthcare providers maintain financial stability and avoid disciplinary actions.

Benefits of Understanding Medical Claims

Understanding medical claims offers numerous advantages for healthcare providers and patients alike. It streamlines administrative processes, enhances financial stability, and improves overall patient care. The key benefits of understanding medical claims include the following:

1. Improved Revenue Cycle Management

Understanding medical claims can significantly enhance revenue cycle management by ensuring accurate billing and timely reimbursements. When healthcare providers have a clear grasp of the claims process, they can minimize errors that lead to claim denials and delays. This efficiency not only speeds up the payment cycle but also reduces the administrative burden associated with re-submitting claims. Moreover, a well-managed revenue cycle can improve cash flow and financial stability for healthcare organizations, allowing them to invest in better patient care and advanced medical technologies. Effective revenue cycle management ultimately leads to a more sustainable healthcare system.

2. Enhanced Efficiency

A thorough understanding of medical claims can lead to enhanced efficiency within healthcare organizations. By streamlining the claims process, healthcare providers can reduce the time and resources spent on administrative tasks. This efficiency allows medical staff to focus more on patient care rather than paperwork. Additionally, clear comprehension of claims can help in identifying and rectifying common errors quickly, thereby reducing the need for rework and follow-ups. Enhanced efficiency not only improves operational workflows but also contributes to better resource allocation and overall organizational productivity.

3. Better Patient Experience

When healthcare providers understand medical claims well, it directly translates to a better patient experience. Patients benefit from transparent billing processes and quicker resolution of their claims, which reduces stress and confusion. Clear communication about what is covered by insurance and what is not helps patients make informed decisions about their healthcare. Moreover, efficient claims processing ensures that patients are not burdened with unexpected costs, thereby enhancing their trust and satisfaction with the healthcare provider. A positive patient experience is crucial for maintaining long-term patient relationships and improving health outcomes.

4. Reduced Fraud and Errors

A deep understanding of medical claims is essential for reducing fraud and errors in the healthcare system. By being knowledgeable about the claims process, healthcare providers can implement stringent checks and balances to detect and prevent fraudulent activities. This includes verifying the accuracy of claims and ensuring that they comply with regulatory standards. Reducing errors in claims not only prevents financial losses but also protects the integrity of the healthcare system. Accurate claims processing helps in maintaining compliance with legal requirements and fosters a culture of accountability and transparency.

5. Data-Driven Insights

Understanding medical claims can provide valuable data-driven insights that can be used to improve healthcare services. Analyzing claims data helps in identifying trends and patterns related to patient care, treatment outcomes, and resource utilization. These insights can inform decision-making processes, leading to more effective and efficient healthcare delivery. For instance, data from claims can highlight areas where costs can be reduced without compromising the quality of care. Additionally, it can help in predicting future healthcare needs and planning accordingly. Data-driven insights derived from claims are crucial for continuous improvement and innovation in healthcare.

6. Cost Savings

A comprehensive understanding of medical claims can lead to significant cost savings for healthcare providers. By minimizing errors and reducing the incidence of claim denials, healthcare organizations can avoid the costs associated with reprocessing claims. Efficient claims management also reduces administrative overheads and the need for additional staffing. Furthermore, insights gained from analyzing claims data can help in identifying cost-saving opportunities, such as negotiating better rates with suppliers or optimizing resource allocation. Cost savings achieved through effective claims management can be reinvested in improving patient care and expanding healthcare services.

7. Improved Communication

Effective communication is a key benefit of understanding medical claims. Healthcare providers who are well-versed in the claims process can communicate more clearly and accurately with patients, insurance companies, and other stakeholders. This clarity helps in setting realistic expectations and resolving any issues promptly. Improved communication also fosters better collaboration among healthcare teams, ensuring that everyone is on the same page regarding patient care and billing processes. Clear and transparent communication builds trust and enhances the overall efficiency of the healthcare system.

8. Faster Issue Resolution

A thorough understanding of medical claims enables faster resolution of issues that may arise during the claims process. Healthcare providers can quickly identify and address discrepancies, reducing the time taken to process claims. This prompt resolution minimizes delays in payments and ensures that patients are not left waiting for their claims to be settled. Faster issue resolution also reduces the administrative burden on healthcare staff, allowing them to focus more on patient care. Efficient handling of claims issues contributes to a smoother and more reliable healthcare experience for both providers and patients.

FAQs

1. What is the difference between medical malpractice claims and medical reimbursement claims?

Medical malpractice claims involve legal actions taken by patients due to harm caused by healthcare providers, while medical reimbursement claims are requests for payment submitted by healthcare providers to insurance companies for services rendered.

2. How can patients check the status of their medical claims?

Patients can check the status of their medical claims through their insurance company’s online portal or by contacting their healthcare provider’s billing department. Some providers may offer email or SMS updates on claim progress.

3. What is the typical time frame for medical claim processing?

The time frame for processing a medical claim varies depending on the insurance provider, the complexity of the claim, and whether any issues arise. On average, claims take 30-45 days to process, but it can be shorter for electronic claims.

4. Can patients dispute a denied medical claim?

Yes, patients can dispute a denied medical claim by filing an appeal with their insurance provider. They will need to provide additional information or correct errors in the claim to support their appeal.

5. How do healthcare providers ensure medical claims are accurate?

Healthcare providers typically rely on billing specialists or automated software to accurately code procedures and patient details, ensuring claims are compliant with insurance regulations and reducing the risk of denials.

6. What is the role of medical coders in the claims process?

Medical coders translate patient records into standardized codes (e.g., ICD, CPT) that are used in medical claims. Accurate coding is crucial for claim approval and reimbursement from insurance companies.

7. What are common reasons for medical claim rejections?

Common reasons include incorrect patient information, missing or incorrect procedure codes, services not covered by the insurance plan, and lack of prior authorization for certain treatments.

8. Are there penalties for submitting fraudulent medical claims?

Yes, submitting fraudulent medical claims can result in severe penalties, including fines, criminal charges, and exclusion from participating in government healthcare programs like Medicare and Medicaid.

9. Can patients submit their own medical claims, or must they go through healthcare providers?

In most cases, healthcare providers submit medical claims on behalf of patients. However, in some instances, patients can submit their own claims to insurance companies, especially for out-of-network providers or certain out-of-pocket expenses.

10. What should patients do if their insurance only partially covers a medical claim?

If a claim is only partially covered, patients should review their insurance plan’s Explanation of Benefits (EOB) to understand why. They can then either pay the remaining balance or appeal if they believe more should be covered.